Paying off a loan is a significant financial milestone, a time for celebration as you close a chapter on debt. Whether it's a mortgage, auto loan, or personal loan, understanding the payoff process is crucial for a smooth and efficient experience. If you're a Wells Fargo customer seeking to pay off your loan, you might have come across the term "Wells Fargo payoff request fax." This article will delve into the intricacies of this process, guiding you through each step to ensure a seamless payoff journey.

In today's digital age, where emails and online portals dominate communication, the use of fax might seem like a blast from the past. However, some financial institutions, including Wells Fargo, still utilize fax for specific transactions, including loan payoff requests. This method provides an extra layer of security and verification, ensuring that sensitive financial information is handled with utmost care.

Requesting a Wells Fargo payoff request fax is often the initial step toward closing out your loan. This document outlines the total amount you need to pay to fully satisfy your loan obligation as of a specific date. It factors in principal, accrued interest, and any applicable fees. Obtaining this document is crucial, as it provides you with a clear understanding of your final payment responsibility, preventing any surprises during the payoff process.

While the concept of using fax might seem daunting in a world accustomed to instant online transactions, understanding its significance in this context is essential. The process itself is relatively straightforward, but familiarizing yourself with the steps involved can save you time and potential headaches. This article aims to demystify the Wells Fargo payoff request fax process, providing you with the knowledge and resources to navigate it with confidence.

Throughout this guide, we'll explore the various aspects of the Wells Fargo payoff request fax process, including the reasons behind its use, the information it contains, and the steps to obtain and submit it. We'll also address common questions, potential challenges, and provide helpful tips to ensure a smooth and efficient payoff experience. Remember, knowledge is power, and by arming yourself with the right information, you can approach your loan payoff with confidence and clarity.

Advantages and Disadvantages of Using Wells Fargo Payoff Request Fax

| Advantages | Disadvantages |

|---|---|

| Enhanced Security | Slower Processing Time |

| Official Documentation | Limited Accessibility |

Best Practices for a Smooth Payoff Process

1. Gather Loan Information: Before initiating the payoff process, locate your loan account number and any other relevant details associated with your Wells Fargo loan. Having this information readily available will streamline the request procedure. 2. Contact Wells Fargo: Reach out to Wells Fargo's customer service department to request the payoff request fax. Explain your intention to pay off your loan and inquire about the specific fax number and any required documentation. 3. Complete the Payoff Request: Upon receiving the fax template or form, carefully fill in all the required information, ensuring accuracy and completeness. Double-check figures, dates, and contact information before submitting the request via fax. 4. Confirmation and Verification: After sending the fax, follow up with Wells Fargo to confirm receipt of your payoff request. Verify the processing timeframe and inquire about any next steps or confirmation methods. 5. Review and Finalize: Once you receive the official payoff statement, review it carefully to ensure accuracy and alignment with your initial request. If everything checks out, proceed with making the final payment according to the instructions provided by Wells Fargo.

Remember, while navigating financial procedures might seem complex, resources and support are available to assist you. By understanding the Wells Fargo payoff request fax process, following the outlined steps, and seeking clarification when needed, you can confidently move towards a debt-free future.

Safety first water adventures with a childs life vest

Unlock coastal calm with benjamin moore shoreline paint

Navigating colognes christmas magic a guide to the markets

Fillable Online Wells Fargo Payoff Request Form - Khao Tick On

Fillable Online Wells Fargo Payoff Request Form. Wells Fargo Payoff - Khao Tick On

Nh 719 News Sale Clearance - Khao Tick On

Wells Fargo 401k Loan Payoff - Khao Tick On

Fillable Online Wells Fargo Payoff Request Form - Khao Tick On

Wells Fargo Bank Statement Template Line Mortgage Wells Fargo Line - Khao Tick On

Fillable Online chroniclingamerica loc FAQS EIGHT - Khao Tick On

Printable Fillable Editable Wells Fargo Bank Statement Template - Khao Tick On

14 credit request form template - Khao Tick On

Fillable Online Wells fargo overnight payoff address Fax Email Print - Khao Tick On

Fillable Online Wells Fargo Payoff Request Form. Wells Fargo Payoff - Khao Tick On

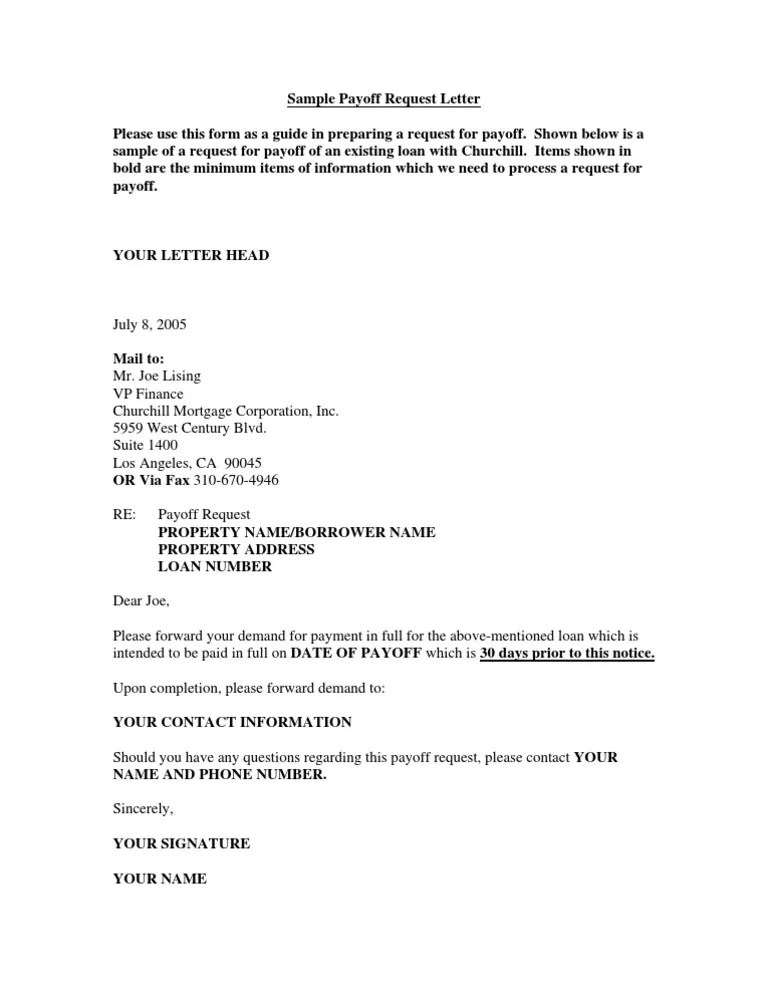

Sample Payoff Request Letter - Khao Tick On

Wells Fargo Loan Payoff Form - Khao Tick On

Nh 719 News Sale Clearance - Khao Tick On

Fillable Online Wells Fargo Payoff Request Form - Khao Tick On